It took the FBI two and a half years of investigation before it eventually caught up with the founder of the darknet marketplace, Silk Road.

It all began on a gray morning in October 2013; federal agents quietly surrounded a small public library in San Francisco. The man they were there to arrest sat at a table, wearing a hoodie and working on a laptop. When they closed in, the open web browser on his screen showed the Silk Road administrative interface—the private control panel of a site that had for years functioned as one of the web’s largest illicit marketplaces. In that instant the myth of impenetrable dark web anonymity cracked. The story of Silk Road is equal parts modern technology, human error, and dogged investigative work. It is also the story of billions of dollars in virtual currency: Bitcoins that once flowed through Silk Road and, nearly a decade later, were traced, seized, and forfeited to the U.S. government.

This is how it happened.

Silk Road was built on Tor and Bitcoin

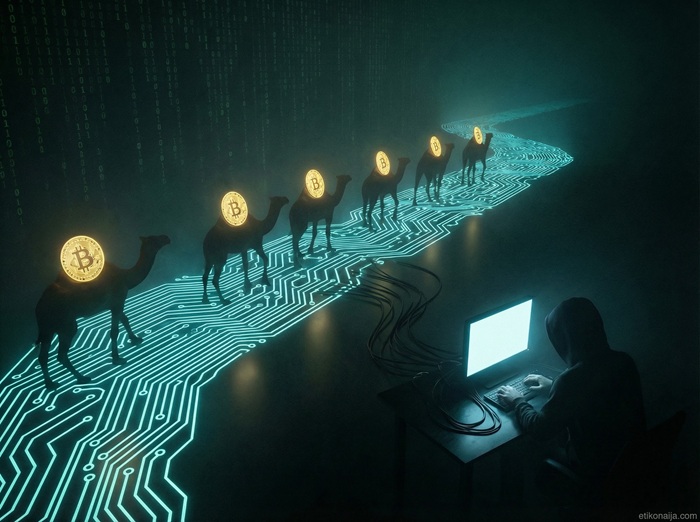

Silk Road began as an experiment. Built as a “hidden service” on Tor, the marketplace allowed buyers and sellers to communicate and transact without direct exposure to the open internet. Payments used Bitcoin — at the time a niche digital currency prized for its pseudo-anonymity and decentralized design. For users seeking illegal goods, Silk Road was revolutionary: private, convenient, and global. Over its run between 2011 and 2013, Silk Road processed millions of transactions and amassed enormous Bitcoin balances. The site’s operator used the nom de guerre “Dread Pirate Roberts,” an intentionally theatrical alias lifted from fiction.

The environment Silk Road exploited rested on two pillars: Tor’s onion-routing for network anonymity, and Bitcoin’s public ledger — a blockchain that records every transfer in permanent, timestamped entries. At first glance, those two technologies combined into a fortress. Tor obscured who connected to the site; Bitcoin provided a way to move value across borders without banks. But those systems also left traces — artifacts that clever investigators could follow if they knew where to look.

How he was caught

The greatest weakness of any anonymous operation is human error. Silk Road’s downfall began not with a flawless cyberbreach, but with a trail of ordinary mistakes and oversights. Investigators pieced together multiple threads: early forum posts and job adverts that used real or reused handles; email addresses tied to those handles; server configuration errors; and network logs showing connections to the real world. Over time, federal agents used search warrants and court orders to gather records from ISPs, hosting providers, and registrars. Those records, combined with undercover online operations and traditional investigative work, narrowed the list of suspects until Ross Ulbricht — a 29-year-old with a degree in physics and a soft spot for libertarian ideology — moved from possibility to person.

One investigative thread began with a job posting and an email address. Agents tracked that email — and the online footprints that used similar aliases — across a series of sites and registration records. Another break came when agents imaged Silk Road’s server and recovered configuration artifacts and log files. The server image contained more than code: it included wallet keys, transaction records, and administrative identifiers that linked to accounts and usernames. In short, the digital evidence in investigators’ hands made the site less a phantom and more a mapped system.

The arrest

The arrest itself was cinematic but methodical. Federal agents had enough evidence to secure arrest and search warrants; they executed them and found Ulbricht seated with his laptop. The machine was open on Silk Road’s admin pages and contained other incriminating artifacts: chat sessions, account data, and a Bitcoin wallet containing large sums. Prosecutors later emphasized that Ulbricht had been operating through Tor and Bitcoin precisely to avoid detection — but the combination of recovered server images, network tracing, and linked online identities allowed law enforcement to connect the dots. Ulbricht would be charged, tried, convicted on multiple counts — including operating a criminal enterprise and money laundering — and ultimately sentenced to life in prison.

How investigators traced Bitcoin and users on a public ledger

Bitcoin’s ledger is public. Every transaction and balance appears in the blockchain, tied to addresses that look like random strings. That public record is both a weakness and a strength: anyone can see flows of value, but addresses are pseudonymous unless linked to real-world identities.

Once law enforcement obtained wallet data and blockchain addresses tied to Silk Road operations — from seized servers, wallets on Ulbricht’s laptop, or clandestine entries — they could follow transactions through time. That required a new discipline: cryptocurrency forensics. Companies like Chainalysis (and in-house lab teams within agencies like IRS-CI and the FBI) build tools that cluster addresses, trace flows through mixers and exchanges, and map where coins ultimately land — often at cryptocurrency exchanges that must comply with KYC (know your customer) rules. Exchanges become choke points: when illicit coins touch a regulated exchange, investigators can subpoena account records to reveal names, IP addresses, and banking links.

But criminals evolved too. Over the years, Silk Road coins were a valuable target for thieves and opportunists. Some coins stayed on dark-web wallets; others moved through mixers and offshore services in an attempt to launder their origin. That pattern produced complex chains of transactions — but every hop is another data point. Investigators developed algorithms to identify patterns that indicate laundering, timing attacks, or reuse of addresses. They also exploited mistakes by criminals: reusing addresses across services, or converting to fiat at exchanges that enforce KYC. Those weaknesses allowed law enforcement to make identifications that once seemed impossible.

The long game: finding 50,000 missing Bitcoins

Perhaps the most headline-grabbing moment came years after the Silk Road shutdown. In November 2021, IRS agents executed a search warrant at a home in Gainesville, Georgia, recovering roughly 50,676 Bitcoin. The chain of custody and the fingerprints on those coins tied them back to a 2012 scheme in which an individual exploited Silk Road’s withdrawal mechanics to steal funds. That person, James Zhong, later pled guilty to wire fraud. At the time of seizure the cache was worth more than $3.36 billion; by the time of later forfeiture proceedings the dollar value fluctuated as markets moved, but the legal fact remained: law enforcement had recovered one of the largest crypto hauls in history.

How did investigators get there? The answer again blends traditional police work with blockchain tracing. Chainalysis and other forensic firms provided technology that mapped the stolen coins’ flows. Despite Zhong’s attempts to hide the funds — including storing private keys on hardware, using mixers, and routing through overseas exchanges — a combination of subpoena power, cooperative exchanges, file analysis of seized devices, and painstaking blockchain work allowed agents to trace the coins to wallets under Zhong’s control. In some telling details, agents recovered certain wallets and keys physically stored in household containers — even a popcorn tin — which underlines the constant truth of cyber investigations: digital value often rests on analog mistakes and physical traces.

Prosecutions, forfeiture, and the politics of punishment

Ross Ulbricht’s prosecution produced a dramatic conviction: multiple counts including conspiracy to traffic narcotics and money laundering, and a sentence of life without parole. His case sparked debate about proportionality, free-speech implications, and the treatment of new-technology crimes. Meanwhile, the later seizures — including the massive 2021 recovery of Silk Road-linked coins — tested courts and prosecutors on the complexities of valuing crypto assets, forfeiture procedures, and the chain of custody for digital evidence. The government’s actions also signaled a strategic posture: follow the money over time, even years later, and use both technological partners and classic police craft.

For criminals, the message is practical: sophisticated attempts to hide cryptocurrency are often undone by simple things — reused addresses, careless registration of aliases, or converting coins on regulated platforms. For investigators, the message is equally practical: new crimes demand new capabilities, but the old rules still apply. Pursue the money, subpoena the data, and never underestimate the value of ordinary investigative techniques.

For the public and regulators, Silk Road provides case studies for policy: how to balance privacy and accountability, how to regulate intermediaries, and how to prepare for crimes that mix the digital and the physical. The $3.36 billion seizure stands as both a trophy and a warning — valuable proof that law enforcement can and will adapt.